Facts and Figures

1,487 MILLION

Sales revenue in euros

The amount generated by the consolidated companies of BPW Group in the 2017 financial year. The total represents a year-on-year increase of 8.3 percent.

565,962

HEAVY AXLES FOR LOADS OF MORE THAN 5.5 TONNES

The number of units sold by BPW Group in the 2017 financial year. BPW is the largest manufacturer of running gear for trailers worldwide, and Europe’s biggest producer of disc and drum trailer brakes.

7,196

employees

The number of people employed by BPW Group in more than 50 countries across the world – from the Silk Road to the Kalahari Desert. Measured against the 2016 total, the labour force has grown by 3.8 percent. The increase reflects sustained success in a stimulating market environment, strategic acquisitions in the aftermarket parts sector, and systematic investment in innovative business segments.

MARKET TRENDS

IN 2017 BPW GROUP CONTINUED TO PERFORM WELL IN AN INCREASINGLY CHALLENGING MARKET ENVIRONMENT.

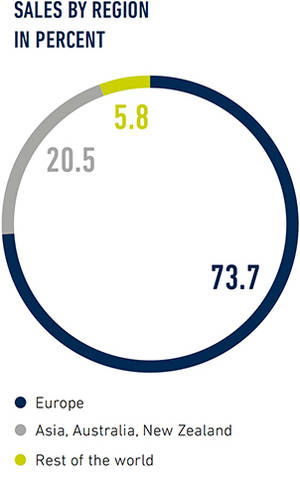

Buoyed by the favourable economic climate in Germany and the eurozone, BPW posted substantial increases in both the volume of sales and turnover. Revenue was more or less unchanged in Germany and declined in the UK, where marked share increased slightly, in the foreshadow of Brexit. while yet slightly increasing in market share. Significant gains were recorded in Turkey and Russia. Business expanded in other markets as well, including Australia, South Africa and Japan. In 2018 we expect conditions to remain conducive to growth, which will be reflected in Europe in particular by positive effects arising in the wake of the euro crisis. Palpable risks nonetheless exist because of trade protectionism initiated by the US, and raw material prices need to be watched carefully throughout the boom phase. From an overall perspective, further growth is anticipated for BPW Group despite these pressures.

| 31.12.2017 | 31.12.2016 | |

| EUR | EUR | |

| A. Fixed assets | ||

| I. Intangible assets | ||

| 1. Industrial property rights and similar rights and assets | 9,542,911 | 8,771,786 |

| 2. Goodwill | 14,342,268 | 20,065,635 |

| 3. Advance payments | 1,546,950 | 1,114,998 |

| 25,432,129 | 29,952,419 | |

| II. Tangible assets | ||

| 1. Land and buildings | 173,806,174 | 175,662,431 |

| 2. Technical equipment and machinery | 119,144,146 | 115,651,034 |

| 3. Other equipment, operating and office furnishings | 37,001,012 | 37,805,974 |

| 4. Advance payments and assets under construction | 19,992,601 | 27,121,741 |

| 349,943,933 | 356,241,180 | |

| III. Financial assets | ||

| 1. Shares in affiliated companies | 1,419,434 | 1,883,279 |

| 2. Loans to affiliated companies | 1,349,036 | 665,853 |

| 3. Shareholdings | 1,349,036 | 279,020 |

| 4. Long-term investments | 2,729,225 | 2,879,356 |

| 5. Other loans | 2,213,532 | 2,280,310 |

| 9,308,241 | 7,987,818 | |

| 384,684,303 | 394,181,417 | |

| B. Current assets | ||

| I. Inventories | ||

| 1. Raw materials and consumables | 82,421,285 | 75,930,138 |

| 2. Unfinished goods | 76,547,228 | 67,264,041 |

| 3. Finished goods and merchandise | 172,616,272 | 156,401,447 |

| 331,584,785 | 299,595,626 | |

| II. Receivables and other assets | ||

| 1. Accounts receivable trade | 270,002,779 | 236,179,545 |

| 2. Receivables from affiliated companies | 766,629 | 198,131 |

| 3. Receivables from companies in which participating interests are held | 0 | 13,059 |

| 4. Other assets | 32,701,288 | 26,397,531 |

| 303,470,696 | 262,788,266 | |

| III. Securities (other) | 19,375,665 | 20,506,392 |

| IV. Cash in hand and cash in banks | 87,119,911 | 91,880,464 |

| 741,551,057 | 674,770,748 | |

| C. Accruals and deferred items | 4,942,453 | 4,995,487 |

| D. Deferred tax assets | 15,802,784 | 15,279,161 |

| 1,146,980,597 | 1,089,226,813 | |

| 31.12.2017 | 31.12.2016 | |

| EUR | EUR | |

| A. Equity | 611,865,932 | 584,841,602 |

| B. Provisions | ||

| 1. Provisions for pensions and similar obligations | 44,025,791 | 42,611,331 |

| 2. Tax provisions | 2,872,695 | 2,812,972 |

| 3. Other provisions | 58,371,844 | 42,476,585 |

| 105,270,330 | 87,900,888 | |

| C. Liabilities | ||

| 1. Liabilities to banks | 72,402,960 | 58,849,493 |

| 2. Advance payments received on orders | 8,317,553 | 377,909 |

| 3. Accounts payable trade | 101,927,114 | 97,239,169 |

| 4. Liabilities to companies in which participating interests are held | 101,113 | 143,080 |

| 5.Other liabilities | ||

| (thereof from taxes EUR 10,499,329; previous year: EUR 9,989,719) | ||

| (thereof relating to social security EUR 3,857,133; previous year: EUR 3,648,583) | 241,724,115 | 253,740,884 |

| 424,472,855 | 410,350,535 | |

| D. Accruals and deferred items | 5,371,480 | 6,133,788 |

| 1,146,980,597 | 1,089,226,813 |

Notes to the consolated balance sheet

as of 31 December 2017

| 1. Sales revenue | 1,486,611,013 | 1,373,399,417 |

| 2. Wages, salaries, social levies and expenses for pensions and social benefits | 298,799,652 | 284,263,962 |

| 3. Number of employees | 7,196 | 6,929 |

Wiehl, August 2018, the Board of Management

Independent auditor's report

The preceding financial information presents extracts from the audited consolidated financial statements for the business year from 1 January to 31 December 2017. With reference to the full set of consolidated financial statements and the group management report we have issued the following auditor's report dated 17 August 2018:

AUDITOR’S REPORT

We have audited the consolidated financial statements prepared by BPW Bergische Achsen Kommanditgesellschaft, Wiehl, comprising the balance sheet, the income statement and the notes to the consolidated financial statements, together with the group management report for the business year from 1 January to 31 December 2017. The preparation of the consolidated financial statements and the group management report in accordance with German commercial law is the responsibility of the parent company’s Managing Directors. Our responsibility is to express an opinion on the consolidated financial statements and the group management report based on our audit.

We conducted our audit of the consolidated financial statements in accordance with § 14 of the German Disclosures Act (PublG), § 317 of the German Commercial Code, and the German generally accepted standards for the audit of financial statements promulgated by the Institut der Wirtschaftsprüfer (Institute of Public Auditors in Germany) (IDW). Those standards require that we plan and perform the audit such that misstatements material ly affecting the presentation of the net assets, financial position and results of operations in the consolidated financial statements in accordance with (German) principles of proper accounting and in the group management report are detected with reasonable assurance. Knowledge of the business activities and the economic and legal environment of the Group and expectations as to possible misstatements are taken into account in the determination of audit pr ocedures. The effectiveness of the accounting-related internal control system and the evidence supporting the disclosures in the consolidated financial statements and the group management report are examined primarily on a test basis within the framework of the audit.

The audit includes assessing the annual financial statements of the companies included in consolidation, the determination of the companies to be included in consolidation, the accounting and consolidation principles used and signific antestimates made by the company’s Managing Directors, as well as evaluating the overall presentation of the consolidated financial statements and the group management report. We believe that our audit provides a reasonable basis for our opinion.

Our audit has not led to any reservations.

In our opinion based on the findings of our audit, the consolidated financial statements comply with the legal requirements and give a true and fair view of the net assets, financial position and results of operations of the Group in accordance with (German) principles of proper accounting. The group management report is consistent with the consolidated financial statements and as a whole provides a suitable view of the Group’s position and suitably presents the opportunities and risks of future development.

Cologne, 17 August 2018

SJS Schwieren Jansen Scherer GmbH

Auditors / Tax Consultants